Gone are the days of traditional accounting with its manual records and spreadsheets, where hours were spent navigating complex calculations and ensuring data accuracy. For businesses to scale in today’s fast-paced digital environment, they demand efficiency, agility, and real-time decision-making capabilities. Enter online accounting services software—the modern solution to financial management that harnesses the power of the cloud to streamline and enhance the accounting processes of businesses big and small.

This innovative approach not only simplifies the previously arduous tasks of accounting but also transforms them into a strategic asset for businesses, enabling them to access their financial data anytime, anywhere. With its significant benefits including improved accuracy, enhanced security, and seamless integration with other business functions, online accounting is redefining the landscape of financial management in the digital age.

What Is Online Accounting?

It refers to the management of financial transactions and accounting tasks using cloud based accounting platforms, rather than a traditional accountant who uses physical ledger books or locally installed software. This approach leverages cloud software to offer real-time, accessible, and secure financial data management.

Here are some key aspects that define many online accounting services:

Key Characteristics of Online Accounting Software

Cloud Accounting Software

Cloud based accounting software is hosted on remote servers, providing access to data from anywhere with an internet connection. This software contrasts with traditional accounting software that is a desktop software installed on a specific computer or server on-premises.

Real-Time Data Processing

Transactions and financial updates are processed in real time. This allows businesses and their accountants to have up-to-date financial information, facilitating timely decision-making and financial analysis.

Automation of Routine Tasks

Many routine accounting tasks, such as recording entries, reconciling transactions, and generating financial reports, are automated. This reduces the likelihood of human error and frees up time for focusing on more strategic activities.

Integration Capabilities

Online accounting systems can integrate with various other business tools and systems, such as payroll, e-commerce, and customer relationship management (CRM) platforms. This integration helps streamline business processes and improves data accuracy across systems.

Increased Scalability

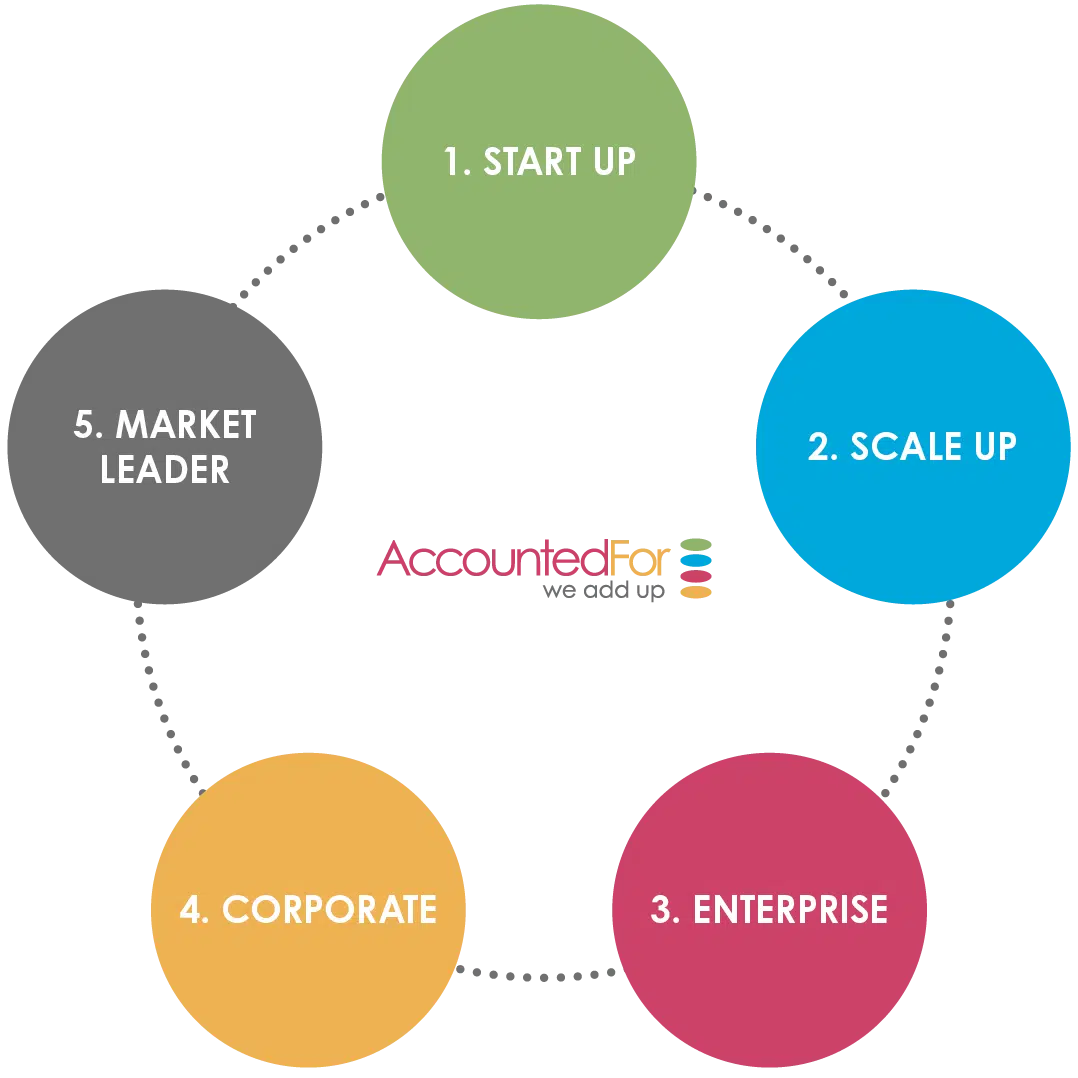

These systems are easily scalable to accommodate the growth of a business, from managing basic transactions of small start-ups to handling complex financial management needs of larger enterprises with international sales.

Subscription-Based Pricing

Online accounting services often operate on a subscription model, offering different tiers based on features, usage, or business size, making it a cost-effective solution for many small businesses.

Online accounting offers businesses a flexible, scalable, and efficient way to handle their financial operations with enhanced accessibility and security. It’s particularly beneficial for small business owners to medium-sized enterprises that may not have the resources to maintain large accounting departments or invest heavily in IT infrastructure.

What Are the Benefits of Online Accounting Services?

Enhanced Accessibility

One of the primary benefits of cloud accounting is the enhanced accessibility it offers for business finances. Unlike traditional accounting, which often requires physical presence and access to paper records, online accounting systems are cloud-based. This means that business owners and their accountants can access financial data from anywhere, at any time, as long as they have internet access. This level of accessibility is particularly beneficial for business owners who are constantly on the go or for those who manage remote teams.

Real-time Information: Online accounting allows for real-time updates and access to financial data, which means that business decisions can be more data-driven and timely.

Multi-user Access: Multiple team members can access the accounting system simultaneously, which facilitates better communication and quicker decision-making processes.

Cost Efficiency

Transitioning to online accounting can also result in significant cost savings for businesses. The reduction in physical resources needed, such as paper, printing, and storage, not only lowers costs but also simplifies the financial management and accounting process itself.

No Large Upfront Costs: Most online accounting services operate on a subscription basis, which means businesses can avoid the hefty upfront costs associated with purchasing offline accounting software or hiring in-house accountants.

Scalability: Online services typically offer various pricing tiers, which enables small business owners to select a plan that best suits their size and needs, with the option to scale up as the business grows.

Improved Security

With the rise of data breaches and cyber threats, security is a top concern for any business. Online accounting systems often offer advanced security measures that are more robust than those a typical small to medium-sized enterprise could afford on its own.

Data Encryption: Financial data is encrypted both during transmission and when stored, which protects sensitive information from unauthorised access.

Regular Backups: Cloud-based systems perform regular backups automatically, ensuring that financial data is not lost due to system failures or disasters.

Compliance and Accuracy

Keeping up with financial regulations and ensuring accuracy in financial reports are critical aspects of business management. Online accounting services help ensure that all your bookkeeping and financial dealings are compliant with current laws and regulations.

Automatic Updates: These systems are regularly updated to reflect the latest tax codes and financial regulations, reducing the risk of compliance issues.

Error Reduction: Automated calculations minimise the risks of errors common in manual accounting, enhancing the overall reliability of financial reports.

Time-Saving Automation

Online accounting services automate many of the time-consuming tasks associated with traditional accounting, such as manual data entry,, invoice creation, and financial report generation.

Automated Transactions: Daily financial transactions can be automatically recorded and categorised appropriately, which saves time and reduces administrative burdens.

Efficient Invoicing: Online systems can generate and send invoices automatically, track them, and update financial records upon payment, streamlining the invoicing process.

Scalable and Flexible

As businesses grow, their cloud accounting system needs become more complex. Online accounting systems are designed to be scalable, offering advanced features and integrations as the business expands.

Customizable Features: Businesses can customise features and integrate other tools with their online accounting systems, such as payroll services, e-commerce platforms, and customer relationship management (CRM) systems.

Environmental Impact

Lastly, by reducing the need for paper-based records and the associated environmental impact, online accounting services contribute to a business’s sustainability goals.

Reduced Paper Use: Digital record-keeping eliminates the need for printing, significantly reducing paper waste.

Energy Efficiency: Cloud servers are often more energy-efficient than maintaining in-house servers, further reducing the environmental footprint.

Expertise and Professional Support

One of the lesser-discussed yet critical advantages of online accounting services is the professional expertise and support offered by online accountants. These professionals are not only skilled in traditional accounting practices but are also adept at leveraging digital tools to provide comprehensive, strategic financial advice.

Diverse Specialisations: Online accountants often possess a range of specialisations, from tax planning and accounting to financial forecasting, which can be matched to the specific needs of your business. This means that companies can benefit from tailored advice that might otherwise be out of reach.

Continuous Education and Updates: As digital tools and regulations evolve, online accountants stay abreast of these changes, continually updating their skills. This ensures that the financial advice and strategies they provide are up to date information based on the latest industry standards and technologies.

Proactive Financial Management: Online accountants use sophisticated analytics tools to monitor financial health and trends. This proactive approach means they can advise businesses on potential financial pitfalls before they become issues and identify opportunities for growth and efficiency improvements.

Collaborative Relationships: Unlike traditional settings where interactions with accountants might be limited to tax season, the digital nature of online accounting fosters ongoing collaboration. This continuous engagement allows accountants to have a deeper understanding of the business dynamics and offer more personalised and timely advice.

Adding Value Beyond Numbers

The role of online accountants extends beyond mere number crunching. They act as strategic partners to businesses:

Strategic Planning: They help in setting financial goals and creating roadmaps to achieve them, providing insights that guide long-term business growth strategies.

Cash Flow Management: Effective cash flow and inventory management is crucial for the survival and growth of any business. Online accountants provide valuable insights into cash flow patterns, helping businesses optimize and forecast their financial operations.

How “Accounted For” Enhances Your Online Accounting Experience

At “Accounted For,” we specialise in providing personalised online accounting solutions tailored to the unique needs of each business. Utilising leading accountancy software and the latest cloud-based platforms, we offer advanced, secure, and user-friendly online software systems accessible from anywhere, anytime. Our services range from automated invoicing and real-time financial reporting to payroll management and tax preparation, ensuring a comprehensive, efficient accounting experience.

We are committed to delivering exceptional value through our flexible pricing models. Clients can choose between a fixed monthly fee for predictable budgeting or a bespoke monthly fee that can be customised according to specific business needs. Each model is designed to provide flexibility and optimise financial expenditure, making “Accounted For” an ideal partner for businesses looking to harness the benefits of streamlined and effective online accounting.

Conclusion

The move to online accounting services offers a myriad of benefits that can lead to substantial improvements in efficiency, cost management, and compliance for businesses. With advantages like enhanced accessibility, improved security, and significant time savings, it is clear why an increasing number of businesses are choosing to embrace this modern approach to managing their finances. As technology continues to advance, the capabilities and benefits of online accounting services will only grow, further solidifying their value to contemporary businesses.