Category: Tax

Personal tax planning for 2023/24

Posted on March 27, 2024 | Tax

Income Tax Rates and Tax Thresholds

The rates and thresholds for UK tax year 2023/24 remain the same as the previous tax year 2022/23 and are …

2023 Spring Budget

Chancellor Jeremy Hunt delivered a ‘Budget for Growth’ after the Office forBudget Responsibility forecast a stronger than expected performance from theUK economy this year with …

Making Tax Digital (MTD) for VAT Extension

The 1st April 2022 marks an important milestone for the Making Tax Digital (MTD) programme.

All VAT registered businesses, regardless of taxable turnover, will legally be required …

Over a million take advantage of extra time to file self assessment returns

Posted on March 25, 2022 | Coronavirus | COVID-19 | Self Employment | Tax

HMRC has revealed that more than one million taxpayers filed their late tax returns in February – taking advantage of the extra time to complete …

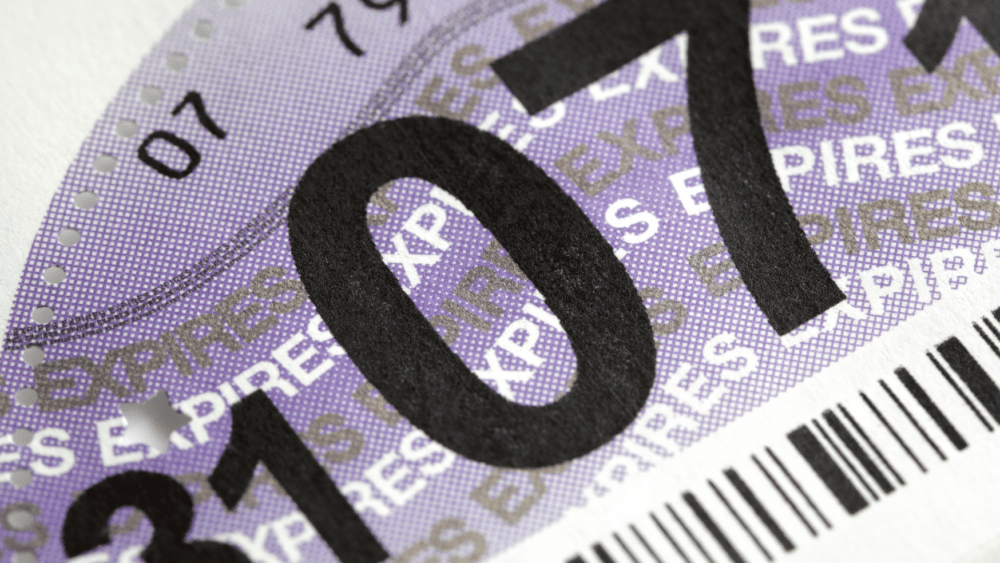

MPs call for road pricing to replace motoring taxes

Posted on March 23, 2022 | Environmental | Tax

The government must overhaul motoring taxes as it phases out new diesel and petrol vehicles, according to MPs.

MPs on the Transport Committee say the government …

HMRC raises late payment interest rate to 3%

Posted on March 21, 2022 | Self Employment | Tax

Following the decision by the Bank of England to increase the base rate, HMRC has confirmed that the late payment interest rate rose a quarter …

National insurance rise ‘set to squeeze budgets’, warns CBI

Posted on February 25, 2022 | Employment | Self Employment | Tax

The Confederation of British Industry (CBI) has warned the government that the planned rise in national insurance will squeeze budgets and affect economic growth.

The rise …

Consumer group urges taxpayers to avoid using refund firms to claim tax rebates

Posted on February 23, 2022 | Employment | Self Employment | Tax

Consumer group Which? has urged taxpayers to avoid using so-called 'refund firms' to claim tax rebates.

Which? stated that people are losing hundreds of pounds by …

Self assessment taxpayers must declare COVID grants on tax returns

Posted on January 19, 2022 | Coronavirus | COVID-19 | Self Employment | Tax

HMRC has reminded self assessment taxpayers to declare any COVID-19 grant payments on their 2020/21 tax return.

According to HMRC, more than 2.7 million customers claimed …

HMRC issues warning on self assessment scams

Posted on December 16, 2021 | Self Employment | Tax

HMRC has warned taxpayers completing their 2020/21 tax returns to 'be on their guard' and stay vigilant in regard to tax-related scams.

Nearly 800,000 tax scams …